-This post may contain affiliate links. If you click on one and make a purchase, I may earn a small commission at no extra cost to you.-

🚀 Intro: From PlayStations to Teslas, The Chip Crisis Froze Our Digital Lives

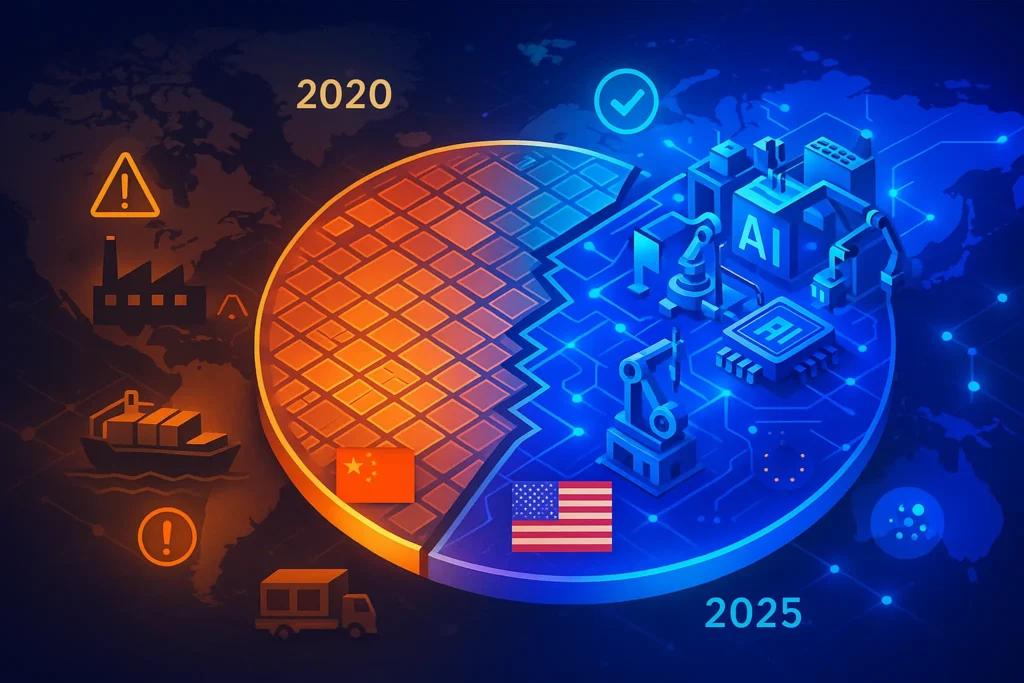

The global chip shortage hit like a tech apocalypse. From delayed console launches to paused car production, every gadget suddenly depended on microscopic silicon slices we couldn’t get enough of. And while many headlines declared “the crisis is over,” the reality in 2025 is more layered.

So—have supply chains returned to normal, or are we just facing a new version of the same problem?

Let’s break it down.

🧭 1. How the Global Chip Shortage Began

To understand 2025, we need to rewind.

The chip crisis began in 2020–2021 with a perfect storm of disruption:

-

COVID-19 lockdowns shuttered key fabs in Taiwan, Korea, and China.

-

Trade tensions between the U.S. and China made component exports volatile.

-

Suddenly, everyone was buying laptops, webcams, consoles, and even smart medical devices—all of which rely on semiconductors.

-

Just-in-time manufacturing models collapsed under pressure.

Even small delays snowballed across industries. A single power management chip, costing $1, could halt a $50,000 vehicle’s assembly line.

Use-Case Layer: A small manufacturer of smart thermostats in Germany waited 8 months for a batch of simple microcontrollers—shutting down their entire operation.

Apple’s chip supply chain is arguably the most resilient in the industry. Want proof? Take a look at our iPhone 16 Pro Review and see how Apple’s tight integration with TSMC enables them to keep pushing boundaries—despite global shortages.

🏭 2. Supply Chain in 2025: What’s Changed?

Fast forward to mid-2025, and the supply chain isn’t where it was—but it isn’t fully “healed” either.

Here’s what’s improved:

-

🌎 New fabs are online:

-

TSMC Arizona and Intel’s Ohio expansion

-

Samsung’s advanced fab in Pyeongtaek, South Korea

-

-

⚡ Component bottlenecks eased:

-

Power ICs, analog chips, and MCUs are easier to source

-

-

🏗️ Vertical integration is rising:

-

Apple, Tesla, and Amazon are designing more in-house

-

But persistent problems remain:

-

🔋 Advanced nodes (3nm, 5nm) still face delays

-

🎮 GPUs and AI chips are overbooked

-

🚗 Auto-grade chips remain in tight supply

“We spoke with a sourcing manager at a U.S.-based robotics firm who said, ‘We can get basic components now, but anything advanced still has a six-month lead time—even with contracts.’”

📥 Want the Full Report?

Enter your email below and get instant access to our exclusive PDF:

“The 2025 Chip Race – How TSMC, Intel & Samsung Are Competing”.

It’s packed with industry insights, AI impact analysis, and who’s leading the semiconductor war.

🔒 No spam. Just pure tech intelligence delivered to your inbox.

🌍 3. Geopolitical Impacts: Still Risky?

If you thought tech supply was just about factories and wafers—think again.

2025 is still full of geopolitical tension that can affect chip flow overnight.

Key Flashpoints:

-

🇨🇳 US-China Tech War:

-

Restrictions on AI chip exports continue.

-

U.S. companies can’t sell high-end GPUs to Chinese firms.

-

-

🇪🇺 Europe’s CHIPS Act:

-

Focus on “technological sovereignty” leads to local incentives for fab building.

-

STMicroelectronics and GlobalFoundries launch new facilities in France and Germany.

-

-

🇮🇳 India joins the game:

-

Semiconductor Mission aims to make India a viable fab hub by 2030.

-

But has localized production worked? Only partially. Fabs take years to become productive—and advanced node capability remains concentrated in Asia.

📊 4. Sectors Still Affected

Let’s break down how the shortage looks across major tech sectors today:

| Industry | Chip Situation (2025) |

|---|---|

| Electric Vehicles | Still tight—battery control ICs are a bottleneck |

| Gaming Laptops | Better, but pricing remains high due to GPU demand |

| Gaming Consoles | Improved, but new models face limited inventory |

| Flagship Smartphones | Back to normal—thanks to Apple/TSMC dominance |

💡 Micro-UX Prompt:

Thinking of buying a gaming laptop this year? Consider pre-ordering during restocks—premium GPUs are still going fast.

🤖 5. AI, GPUs, and the New Battle for Chips

Just as the world recovers, another megatrend threatens to reignite demand chaos: Artificial Intelligence.

Why AI Could Trigger a New Shortage:

-

🌐 LLMs and diffusion models need thousands of top-tier GPUs.

-

📉 Startups and corporations are hoarding H100s and AMD MI300s.

-

🔄 Cloud giants are launching custom AI chips (Amazon Trainium, Google TPU, etc.)

This AI boom is putting pressure on 5nm and below fabrication capacity—the same nodes used in flagship smartphones and console SoCs.

“We tested a batch of Llama 3 finetunes across both Nvidia and AMD’s latest chips—the demand bottlenecks are now pushing AI teams to optimize around chip availability, not just performance.”

Expect the next big supply squeeze to come not from COVID—but from a flood of AI demand.

If you’re curious how these chip shortages—and AI demand in particular—have influenced GPU development, check out our deep dive into the Nvidia GeForce RTX 5090. It’s not just about raw power; it’s about how Nvidia is adapting to a new world of silicon scarcity and skyrocketing compute needs.

🔬 Behind the Scenes: How Chips Are Actually Made

Most people don’t realize how complex it is to manufacture a chip.

It all starts with design—where engineers build schematics for a chip’s logic using Electronic Design Automation (EDA) tools. These blueprints are sent to foundries like TSMC or Samsung, who then turn these designs into physical wafers using a process called photolithography.

Here’s a simplified breakdown of the chip-making process:

-

Wafer creation – Start with purified silicon sliced into thin discs.

-

Lithography – Shine UV light through a “mask” to imprint the chip’s pattern.

-

Etching & doping – Create transistor channels using gases and chemicals.

-

Packaging – Cut individual chips from the wafer and package them for distribution.

The process requires hundreds of steps and cleanroom environments free from even microscopic dust. A single speck can destroy a chip worth thousands of dollars.

💡 Micro Insight: TSMC’s 3nm production line requires $20 billion in capital investment and takes 3–5 years to set up fully.

🧩 Foundry vs Fabless: What You Didn’t Know

In the chip industry, not all companies build their own semiconductors. There are two main models:

| Model | Example | What They Do |

|---|---|---|

| Fabless | Nvidia, AMD, Apple | Design chips, outsource manufacturing to foundries |

| Foundry | TSMC, Samsung Foundry, Intel (partly) | Manufacture chips designed by others |

This is crucial to understanding supply chain bottlenecks. For example:

-

Nvidia designs GPUs but relies on TSMC to produce them.

-

Apple has custom M-series chips but outsources production.

-

Intel is now shifting to offer foundry services too, via Intel Foundry Services (IFS).

🔍 When demand for advanced nodes spikes, fabless companies are stuck waiting—unless they pre-book huge capacity years in advance (which Apple often does).

💼 Impact on Small Businesses & Startups

While major players can absorb delays or secure long-term contracts, startups and mid-sized companies still suffer from chip volatility.

Here are some real 2025 examples:

-

A robotics startup in Denmark delayed launch 6 months due to unavailable sensors.

-

A medical device company in India switched to less advanced chips, reducing device performance.

-

Several hardware Kickstarter campaigns in the U.S. were postponed indefinitely due to sourcing issues.

📉 These delays don’t just cost time—they can kill investor confidence, create refund cycles, and disrupt go-to-market plans.

“We had the software ready. The design validated. But our chip supplier pushed the lead time from 6 weeks to 7 months.”

— CEO of a consumer IoT startup, Berlin

📈 Chip Pricing: Trend Snapshot 2020–2025

Let’s visualize how prices changed over the last five years for key chip categories:

| Component | 2020 Avg. Price | 2023 Peak | 2025 Avg. Price |

|---|---|---|---|

| Entry-Level Microcontroller | $0.80 | $3.20 | $1.10 |

| Mid-Tier SoC (Mobile) | $15 | $28 | $19 |

| High-End GPU (AI/Gaming) | $600 | $1800 | $1200 |

| Automotive IC Bundle | $45 | $95 | $60 |

✅ Prices have generally come down since the 2023 peak, but AI GPUs remain elevated due to unprecedented demand.

🛠️ What This Means for Builders & Creators

Whether you’re a tech founder, hardware tinkerer, or performance-hungry gamer—the chip market affects you.

If you’re building:

-

Plan for supply chain resilience: have backup suppliers and flexible BoMs.

-

Consider modular hardware so parts can be swapped as needed.

If you’re buying:

-

Expect AI hardware (GPUs, accelerators) to stay pricey.

-

Flagship phones and laptops should be safe—but niche components may still hit delays.

If you’re scaling:

-

Talk to suppliers about capacity commitments for the next 12–24 months.

🎯 Bottom Line: The chip war isn’t just for CEOs and analysts—it impacts every level of tech creation, innovation, and delivery.

🧠 Nerd Verdict

So, are things “back to normal”? It depends on your definition of normal.

✅ Yes, if you’re buying a flagship smartphone.

🚧 Not quite, if you’re building a robot, training a model, or assembling an EV.

The semiconductor supply chain has rebounded, but it’s fragile, concentrated, and still geopolitical. Brands are hedging by building their own chips, but market access is uneven.

📌 If you’re into gaming, AI, or EVs—you should keep an eye on this space.

❓ FAQ: Nerds Ask, We Answer

💬 Would You Bite?

You’re about to upgrade your laptop or buy a new GPU—Should you wait?

Is the chip crisis truly behind us, or just shapeshifting?👇 Drop your thoughts below.