Intro:

Some years the market sprints; other years it stretches, breathes, and decides what the next decade should look like. 2025 could be one of those decision years for tech—where operating discipline meets product velocity and late-stage startups finally test the public waters. If you’ve ever tried to parse rumors, leaked numbers, and macro headlines at the same time, you know how noisy a pre-IPO season can get. This guide cuts through that noise: what really makes a unicorn “IPO-ready,” five standout candidates to watch closely, and a simple, repeatable framework you can apply to any fresh S-1.

As always, this is analysis—not investment advice. Markets change, windows shut and open, and companies pivot. But the signals we review here tend to travel well from cycle to cycle. And when you’re ready to dive deeper into emerging teams beyond this shortlist, park a tab for Top 5 AI Startups to Watch—it pairs nicely with today’s IPO lens.

💡 Nerd Tip: A great story can open the door; durable unit economics keep it from slamming shut.

🧭 What Makes a Unicorn IPO-Ready in 2025?

Public investors can forgive a lot—seasonality, marketing bursts, even the occasional product detour—if the engine is smooth. In 2025, the “engine test” looks like this:

Operating Discipline, Not Just Growth. The post-zero-rate era didn’t kill growth; it priced it. Healthy late-stage software now often aims for a Rule of 40 north of 40–60, with many quality names leaning into 20–35% growth at 10–20% FCF margins. For consumer platforms, we look for rising contribution margins as cohorts age and paid acquisition dependency declines.

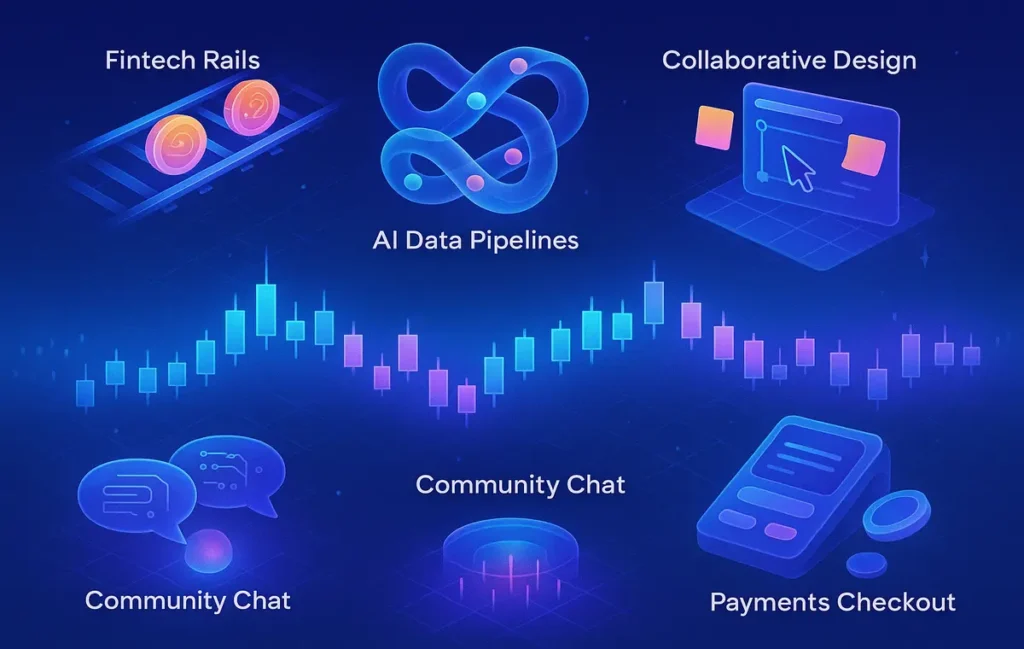

Moat You Can Point To. Moats changed shape. For AI-forward companies, it’s not “we use AI,” it’s privileged data pipelines, fine-tuned models integrated into workflow (not a sidecar), and distribution that compounds. For fintech, durable moats show up in risk models, partner depth, and regulatory muscle memory.

Clean Governance & Path to GAAP Profits. In 2025, dual-class won’t scare every investor, but variable voting power + hazy profit path will. Clean cap tables and line-of-sight to GAAP profitability (or disciplined FCF) reduce the “new issue discount.”

Catalysts Beyond Day 1. Post-IPO blues are common when the only story is “we IPO’d.” We like catalysts queued up: new regions, second product S-curve, or a data advantage compounding quarter by quarter. For richer context on macro hiring and discipline trends shaping these paths, see Global Tech Layoffs & Hiring Trends—it explains a lot about today’s leaner operating models.

💡 Nerd Tip: Before reading any S-1, write your “three reasons it shouldn’t work.” If the filing cancels them clearly, you’ve got signal.

🚀 Stripe — The Fintech Rails That Quietly Power the Internet

What it does. Stripe is connective tissue for the internet economy: payments, billing, tax, fraud, and increasingly financial operations (issuing, treasury, revenue recognition). The deeper you go into its platform, the harder it is to unwind.

Why it’s on watch. Two things define modern fintech moats: risk modeling at scale and ecosystem lock-in. Stripe’s long tail of developers and startups created a bottom-up network effect. As those customers matured, they brought larger volumes and demanded more products (invoicing, tax, RevRec), expanding ARPU without pure price hikes. Investors like that mix—horizontal breadth with vertical depth—and it lowers churn against newer, single-feature challengers.

Key signals in 2025. Watch for enterprise penetration (where procurement cycles are longer but stickier), margins on value-added software vs. core payments, and expansion in geographies with tricky tax and compliance. A resilient take-rate + software attach story lands well in today’s market. If macro slows online spend, look to mix shift (subscriptions, B2B payments) to cushion volume effects.

Risks. Payments is famously competitive. Pricing pressure, regulatory surprises, or any card-network rule changes can ripple through gross margins. Also watch the balance between platform openness and revenue capture—partners need to feel fed, not farmed. If you want the policy angle that sometimes hits large platforms, skim Big Tech Under Fire for the regulatory weather report.

💡 Nerd Tip: In fintech S-1s, read chargeback and fraud disclosures twice. They whisper more truth than glossy growth charts.

🧠 Databricks — The Lakehouse Bet on AI-Native Analytics

What it does. Databricks fused data lake flexibility with warehouse performance (the “lakehouse”), selling not just storage/compute orchestration but governed data + AI workflows end-to-end: ingestion, transformation, model training, and deployment.

Why it’s on watch. AI isn’t one product; it’s a pipeline. Databricks’ edge is being the place where data engineering and data science meet, governed tightly enough for enterprise but agile enough for teams to ship. The company’s acquisitions and model tooling push it toward a control plane for AI-native analytics. If the data gravity lives with you, downstream tools orbit.

Key signals in 2025. Expect investors to zero in on net revenue retention (NRR) and large-customer mix. In an AI arms race, the best indicator is often expansion from platform breadth—when customers buy multiple modules, churn drops and pricing power rises. Gross margin trends matter too; compute-heavy workloads can mask software leverage if priced poorly. For how public markets price AI risk and opportunity, cross-reference AI on Wall Street—it frames sentiment cycles you’ll likely feel here.

Risks. Competitive heat from hyperscalers and entrenched data warehouses is real. The counter is open ecosystem + performance claims investors can verify. Any opacity around model governance or data lineage will be a yellow flag in diligence.

💡 Nerd Tip: Ask “Where does this platform sit when the CFO asks for AI cost controls?” Tools that help with both velocity and unit economics win budget.

🎨 Canva — The Design Platform That Made Creative a Team Sport

What it does. Canva turned design into a collaborative, templatized workflow for non-designers and cross-functional teams. It’s not just “make a pretty social graphic”—it’s brand kits, templates, multiplayer comments, and content routing that permeate marketing and internal comms.

Why it’s on watch. Canva’s magic isn’t only UI simplicity; it’s distribution inside companies. When sales, HR, and ops can ship “on-brand” without waiting on a designer, adoption spreads laterally. That shows up as land-and-expand metrics, and it’s a notable moat because retraining thousands of casual creators is painful. AI features (background removal, text→image, auto-layout) are less about novelty and more about speed-to-asset—time saved adds up across teams.

Key signals in 2025. Look for enterprise penetration vs. individual creators, seat expansion, and the economics of template marketplaces. If Canva can prove high NRR in mid-market/enterprise and keep self-serve happy, it will screen as a rare hybrid. Healthy gross margins and a disciplined path to cash generation will matter more than vanity MAU.

Risks. Competitive offerings from incumbents and newer AI-native design tools could nibble at edges. The defense is workplace stickiness and admin control for brand governance. If you’re thinking longer horizon on creator tools and distribution, peek at AI & Future Tech Predictions for the Next Decade—the “pro-am collaboration” theme resonates here.

💡 Nerd Tip: In product-led growth S-1s, search for “admin,” “brand kit,” or “governance.” Those words signal enterprise readiness more than any glossy logo slide.

📊 Build Your 2025 IPO Watchlist (Free Template)

Track moat, margins, NRR, and catalysts across your favorite late-stage startups—with a one-page “IPO card” you can update after earnings.

🎧 Discord — The Always-On Third Place for Communities

What it does. Discord is persistent, topic-based voice, text, and video with roles, bots, and permissions—originally gamer-centric, now a universal layer for communities, creators, classrooms, and small teams. Think of it as a programmable forum + live audio lounge.

Why it’s on watch. Discord has three engines that public investors understand: Nitro subscriptions (paid enhancements), community-led growth (servers are mini-ecosystems), and emerging commerce & safety tooling (monetizable features with platform value). Its moat is cultural and product-architectural: persistent rooms where people hang out, not just “post and leave.” That use case is hard to replicate, even with deep pockets.

Key signals in 2025. Conversion and retention of Nitro, growth in mid-sized servers beyond gaming, and trust & safety efficacy (a cost center that becomes a competitive advantage when done right). Expect scrutiny on ARPU progression and potential ads vs. privacy trade-offs. For a broader look at how scrutiny shifts for platforms at scale, Big Tech Under Fire offers a useful lens.

Risks. Moderation is expensive, and regulatory expectations rise with influence. If the revenue mix leans too hard on low-ARPU segments without upsell, valuation multiples compress. The bull case is a world where shared presence is the new social feed—and Discord owns the cozy, high-intent variant.

💡 Nerd Tip: For community platforms, follow cohort health. If older servers keep creating value (not just new ones), you’ve got compounding network effects.

💳 Klarna — BNPL 2.0 with a Platform Ambition

What it does. Klarna started as “buy now, pay later” and has been steadily morphing into a shopping and payments platform: discovery, cash-back, creator content, and checkout integrations that sit across merchants and consumers.

Why it’s on watch. The first wave of BNPL chased volume; the second wave is about risk underwriting, merchant economics, and product breadth. Klarna’s push into discovery + checkout + post-purchase is a strategic hedge: if funding costs rise, non-lending revenue and merchant services can buffer returns. The platform thesis is compelling if it proves out at scale.

Key signals in 2025. Contribution margins by geography, loss rates stabilizing with disciplined underwriting, and the share of revenue coming from non-interest products. Investors will also parse cohort profitability: do users get safer (and more profitable) with age? For a macro sense of how financial conditions re-price growth, AI on Wall Street covers the sentiment cycles you’ll feel in fintech, too.

Risks. Regulation, capital costs, and competition from card networks and tech giants are ever-present. If consumer credit weakens, loss provisions can swamp growth optics. The path is proving durable economics in multiple regions with a balanced revenue stack.

💡 Nerd Tip: In fintech, check the funding mix. When funding gets pricier, who eats it—the company, the merchant, or the consumer?

🧪 IPO Readiness Scoreboard (Editorial Estimates)

| Company | Revenue Scale | Growth Durability | Profitability Path | Moat Clarity | Governance Readiness | Overall Readiness |

|---|---|---|---|---|---|---|

| Stripe | High | High | Medium-High | High | Medium-High | A- |

| Databricks | High | High | Medium | High | Medium | A- |

| Canva | Medium-High | High | Medium-High | Medium-High | Medium-High | A- / B+ |

| Discord | Medium-High | Medium-High | Medium | Medium-High | Medium | B+ |

| Klarna | High | Medium | Medium | Medium | Medium-High | B+ |

These are directional editorial views based on common late-stage signals (not forecasts). We weigh product breadth, expansion metrics, G&A discipline, and foreseeable regulatory frictions.

💡 Nerd Tip: Great companies sometimes skip a “perfect” window and still win. The right window is the one that fits their operating arc.

🌤️ The 2025 Window: Macro, Multiples, and What Could Sway Timing

Rates & Risk Appetite. If inflation cools and rate cuts look credible, equity risk premia ease and the market tends to reward quality growth again. That re-opens the window for companies with solid NRR and cash discipline. If volatility spikes, expect a flight to profitability and a shorter leash for high burn.

Sector Multiples. AI infrastructure and workflow winners may command premium EV/revenue multiples relative to general SaaS. Fintech with proven unit economics (especially with non-interest revenue) can also screen well—provided credit trends are cooperative. Consumer platforms must show ARPU and safety investments that keep regulators calm and advertisers comfortable.

Alternative Paths. Secondary sales, structured liquidity for employees, direct listings, or even strategic stakes can delay or replace a classic IPO. Timing often aligns with when the story is clearest rather than the year on the calendar. For the broader decade-long canvas driving many of these arcs, flag AI & Future Tech Predictions for the Next Decade—it’s the backdrop to today’s financing choreography.

As one market watcher on X quipped, “In this cycle, cash flow is the new charisma.” Sensible or snarky—either way, the market is grading that way.

💡 Nerd Tip: The best pre-IPO read: management’s capital allocation philosophy. It survives hype cycles and explains everything else.

🔍 The 15-Minute S-1 Reading Plan (Keep It Minimal, Get the Signal)

1) Growth Quality: Find NRR, large-customer mix, and segment growth. You want expansion that isn’t purely acquisition-driven.

2) Unit Economics: For SaaS/AI, parse gross margins and the mix of compute-heavy workloads. For fintech, study loss rates, funding mix, and contribution margins.

3) Operating Leverage: R&D vs. S&M trajectories, and G&A as a percent of revenue. Discipline beats “spend your way to scale.”

4) Moat in Plain English: Proprietary data, compliance/regulatory assets, network effects, or embedded workflow. If you can’t summarize it in 1–2 lines, it’s probably not a moat.

5) Governance & Risks: Voting structure, related-party quirks, concentration. Then read the risk section with a pen—mark the 3 risks management can actually control.

💡 Nerd Tip: Create a one-page “IPO card” for each name. If you can’t pitch it back in 90 seconds, you don’t own the thesis yet.

📬 Want More Smart AI Tips Like This?

Join our free newsletter and get weekly insights on AI tools, no-code apps, and future tech—delivered straight to your inbox. No fluff. Just high-quality content for creators, founders, and future builders.

🔐 100% privacy. No noise. Just value-packed content tips from NerdChips.

🧠 Nerd Verdict

The pattern across our 2025 watchlist isn’t “growth at any cost”—it’s growth with gravity. Stripe’s platform breadth, Databricks’ AI-native workflows, Canva’s enterprise-friendly PLG, Discord’s durable presence graph, and Klarna’s shift from mono-product to platform all share the same foundation: an engine that scales and pays for itself. Public markets may wobble quarter to quarter, but they keep rewarding compounding moats and measured operating discipline. If you build or back companies, make those the north stars. And if you’re just here for the stories, remember: the best IPOs don’t end a journey; they fund the next arc.

For a thematic follow-through on where these categories are heading, browse AI & Future Tech Predictions for the Next Decade—it’s the macro canvas behind many of these micro moves.

❓ FAQ: Nerds Ask, We Answer

💬 Would You Bite?

If only one of these five priced tomorrow, which would you want in your portfolio—and why?

What “moat proof” convinces you fastest: data advantages, distribution, or operating leverage?

Crafted by NerdChips for analysts, founders, and curious builders who want to read the market, not chase it.